This article is one part of a longer deep dive into Leios, Cardano’s proposed consensus upgrade. The full post is available at https://314pool.com/post/leios. We’ve broken it into smaller, standalone reads to make it more accessible for the Cardano Cube audience.

For the last 6 months, Input Output, along with support from Well-Typed and Sundae Labs, has been studying the real-world behavior of the protocol described above. It’s all well and good to have a research paper in hand that describes the soundness of a protocol; it’s another thing entirely to understand how different choices of protocol parameters impact the real-world performance, and what range of real-world performance and cost such a protocol is likely to be able to achieve.

At the same time, many of these improvements come with tradeoffs, albeit reasonable ones. These tradeoffs can be thought of as currency that the current Cardano protocol has worked hard to accumulate, that we now get to spend on increasing our assets. Understanding these tradeoffs will be key to the successful deployment of the Cardano network.

In the next few sections, I will summarize the main takeaways from that effort, though keep in mind the topic is heavily nuanced even still, and none of this should yet be construed as an absolute promise of the protocol’s capabilities.

Throughput

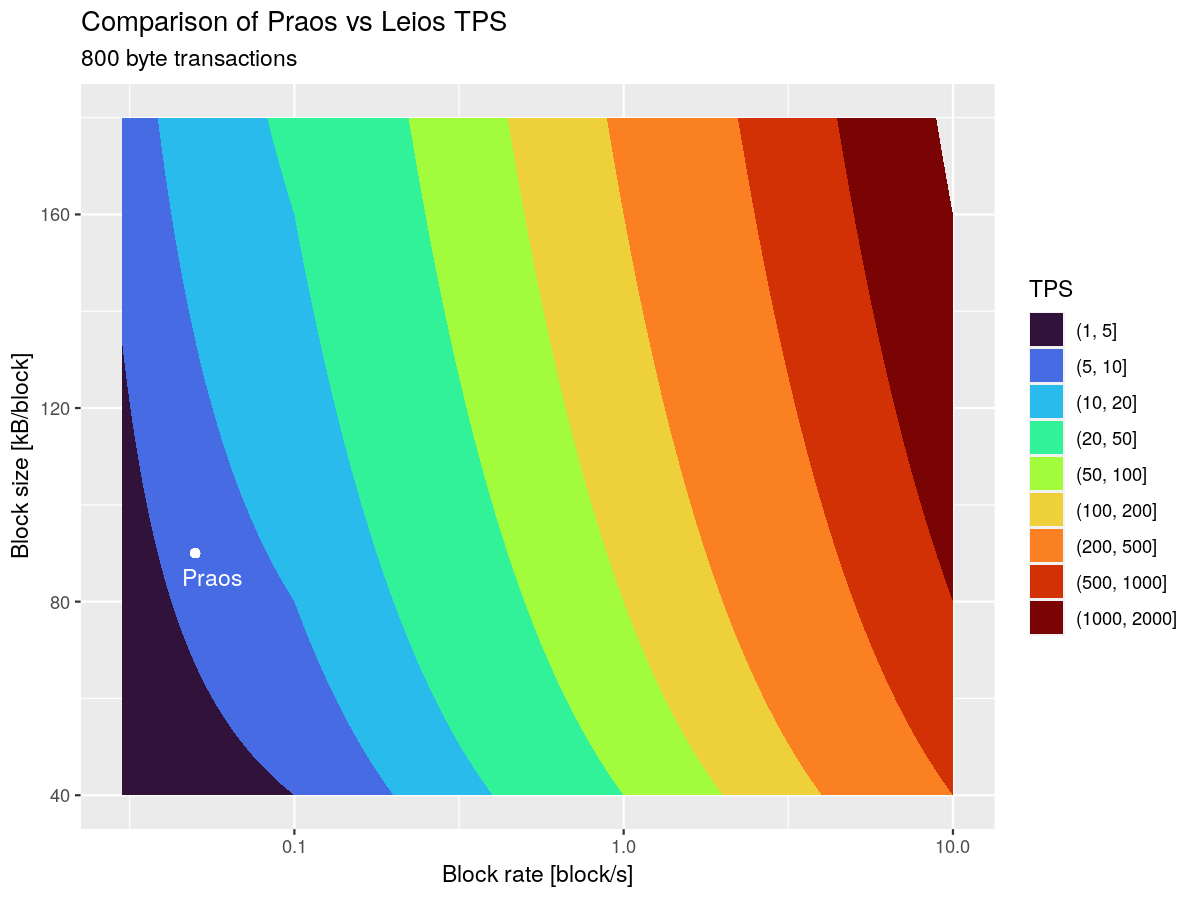

The main variables impacting throughput are the frequency of input blocks and their size. Below is a chart depicting how these impact the overall, steady-state maximum throughput of the protocol, with reference to a “typical” transaction, averaged over all normal, Plutus v2, or Plutus v3 mainnet transactions from epoch 500 to 550. (Note: we exclude Plutus v1 transactions because, even with CIP-110 which enabled reference scripts, they significantly skew the average size of the transaction).

Latency

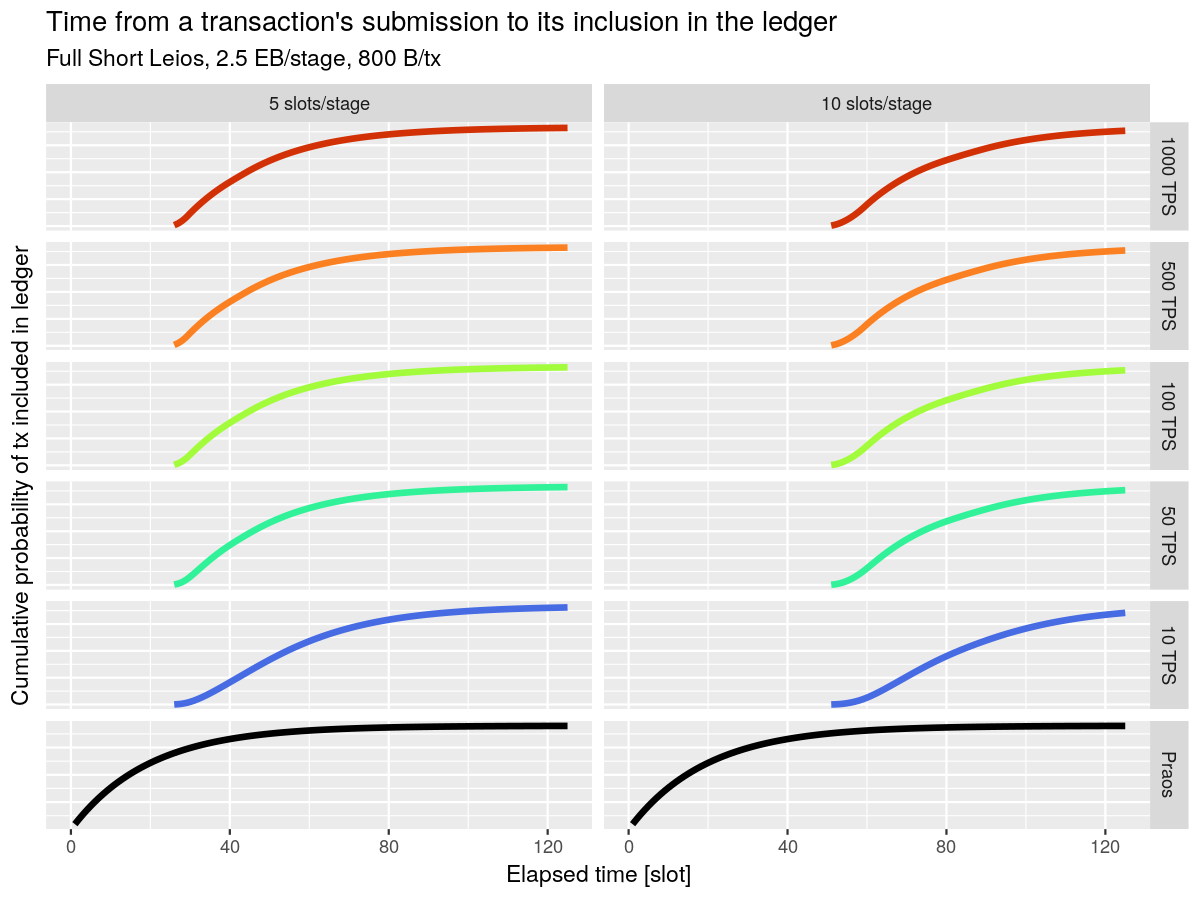

One surprising result of the simulations is related to the latency of transactions. The chart below shows the cumulative probability that a transaction will have made it into a block, at different throughputs and stage lengths.

What this shows is that, while Leios adds a fixed latency to transactions, and that latency is sensitive to the pipeline length, it’s largely independent of the throughput target! We can push Leios to fairly high throughputs by paying a fixed cost of latency!

Additionally, while this may seem damaging to the user experience, when combined with Peras it likely won’t materially change the length of transaction finality.

Today, with Praos, the story around a transaction is “I have decent confidence in a transaction once it gets included in a Praos block, and then have extremely high confidence in the finality once 8 blocks have been produced on top of that one.” Today this is, on average, around 2-3 minutes.

With Leios, the story would be “I have decent confidence in a transaction once it gets included in an endorsement block, and then have extremely high confidence in the finality once 8 blocks have been produced on top of the ranking block.” This would represent a duration of, perhaps, 3-5 minutes.

With Leios plus Peras, the story would be “I have decent confidence in a transaction once it gets included in an endorsement block, and then have extremely high confidence in the finality once a boosted ranking block is produced.” This would represent a duration of, perhaps, 1-3 minutes.

State growth

“State growth” refers to how quickly the permanent storage requirements of a blockchain grow. For example, currently, Bitcoin requires 656.14 gigabytes of storage, and that grows approximately 86.6 gigabytes per year. Ethereum, on the other hand, currently requires 1.3 terabytes of storage, and that grows by 217.42 gigabytes per year.

Cardano currently uses 193 gigabytes of storage, and is growing roughly 28 gigabytes per year. If throughput increases dramatically, that growth rate will increase just as dramatically.

This is a particularly important metric because it impacts the long-term costs of running a node. Each gigabyte of data added to the chain is a gigabyte of data that has to be stored and synchronized between every node, effectively forever. There’s a common accounting technique for pricing this permanent storage: historically, storage has gotten 15% cheaper every year, meaning that an integral of the cost converges to a finite amount. Using this accounting, the cost of storing 1GB of data forever is expected to be roughly the same as paying for 80 months of storage at the current price.

After Leios, it’s likely that the next big innovation we will need to explore is how to tackle this state growth. We could, for example, have a protocol whereby ancient history is sharded among a subset of nodes, rather than being replicated by the entire network.

Network Bandwidth

Leios is designed to optimally saturate the bandwidth available to the network. It’s not surprising, then, that our simulations project that the biggest increases to the cost to run a node under Leios will likely come from the extra data transmitted outward from a node, known as “Network Egress”.

Unfortunately, this is also one of the hardest costs to estimate, because the cost per gigabyte varies so widely across cloud and network providers. If you’re curious, one of the best ways to grapple with these costs for yourself is to play with the numbers in the cost calculator the Leios team has built. Just be aware that these numbers are still preliminary.

Profitability

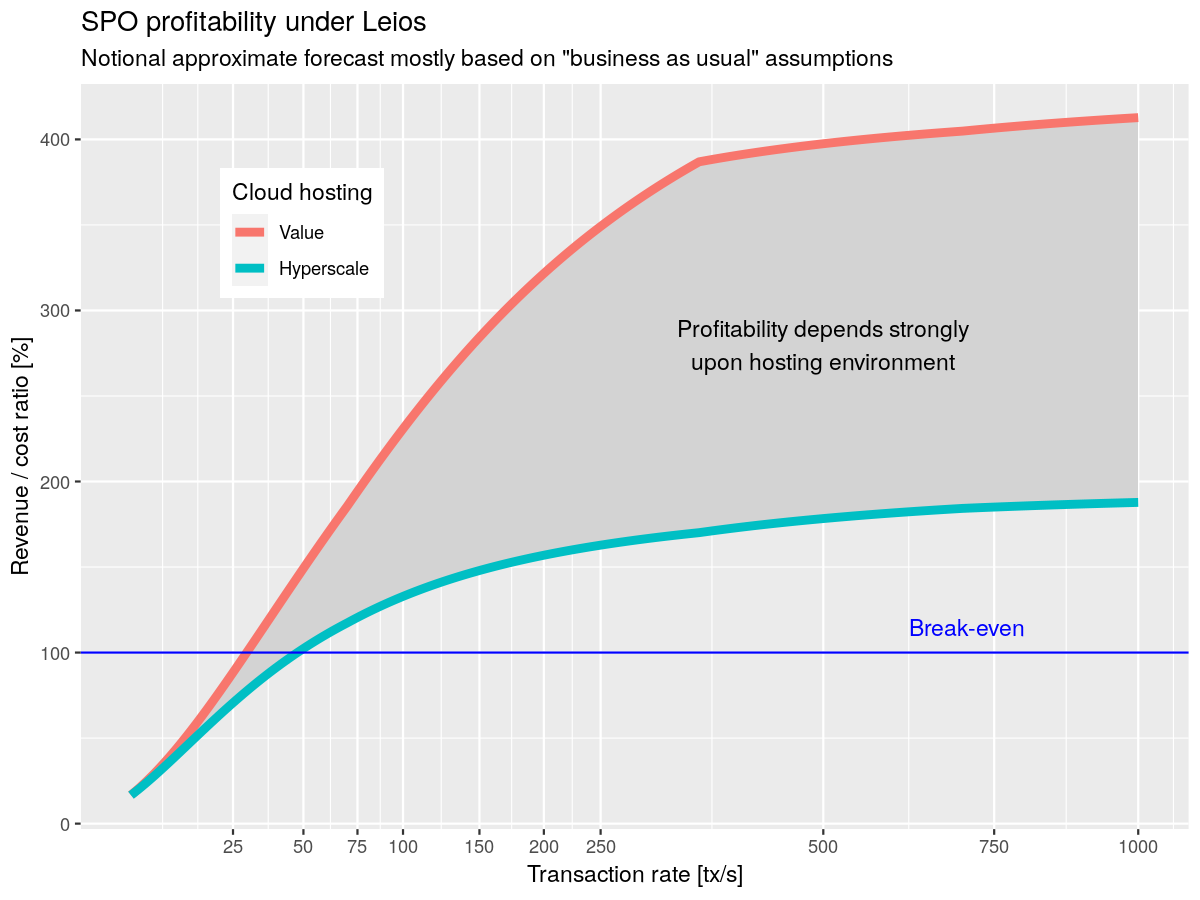

The combined effect of state growth and network bandwidth dominates the added costs for Leios, but the upside is that the transaction fees also contribute to revenue for the node operators. We can reproduce our chart about Praos node profitability above, but this time for Leios. These numbers are hard to estimate, as they depend on many conflating variables, but at least the general trends should become clear.

Note that the horizontal axis uses a square root scale, to emphasize the shape and key points of the curve.

Leios allows the protocol to scale well beyond the break-even point and ultimately drive cheaper fees for users while staying sustainable, making Cardano competitive in the Blockchain landscape.